newsitems

newsitems  EU Parliament +US Congres Hearings question 1999-2000 EuroZone v. Turkey Goldman Sachs' Greek deal

EU Parliament +US Congres Hearings question 1999-2000 EuroZone v. Turkey Goldman Sachs' Greek deal

EU Parliament +US Congres Hearings question 1999-2000 EuroZone v. Turkey Goldman Sachs' Greek deal

Revelations made during crucial Hearings by EU Parliament and US Congress the same Day on what really happened about Debt Crisis in Greece, who was responsible for the 1999-2001 manipulated Accounts, and how to avoid similar problems at EuroZone in Future, opened new Question-marks :

Mainly on the role played by American company Goldman Sachs and other actors during the "Deal" which practically exchanged a too early and unprepared Greece's entry into EuroZone, with the lift of all preexisting Greece's objections to Turkey's controversial EU bid (since Helsinki December 1999 EU Summit), provoking a Double Crisis in the EU : First Institutional, with 3 "No" at EuroReferenda in France, Holland, etc. since 2005, and now (2010) a Financial one, with EuroZone member Greece's current difficulties to borrow money in the Financial Markets at normal rates :

Unanswered Critical Questions by MEPs, f.ex. on "an Enquiry" to establish "possible Crimes" committed by "those (among EU Commission, EuroStat and/or States) who let falsify the Accounts" about Greece since 1999-2001 "and destablized EuroZone", were added to US Federal Reserve's Chairman, Ben Bernake's reference, while speaking about Goldman Sachs' controversial 2000-2001 deals with a former "Socialist" Greek Government, to the .. infamous "ENRON" Scandal, which brought many Executives to be persecuted and condemned to Prison sentences for Manipulating Accounts (See infra)...

In the 1st Hearing, organized by EU Parliament's Economic Committee's Chairwoman, Liberal British MEP Sharon Bowles, with EU Commissioner Oli Rehn (previously on EU Enlargement, and now on EU Economy), EuroStat's Director General Walter Radermacher, and U.S.A.'s Goldman Sachs' Chairman, Gerald Corrigan,, etc., EU Parliament's 1st vice-President, ChristianDemocrat/EPP Greek MEP Rodi Kratsa, after reminding that "the infringement procedure" for excessive Debt had been closed by EU Commission vis a vis Greece back "on 2007", (i.e. during the ChristianDemocrat/EPP former Government of Costas Caramanlis), opened the question-time by asking mainly "what Conclusions" they had made on "the Problem of Greece's Statistics", and "the way Swaps were used in 2001" (i.e. during previous PASOK Governments), which raise "important issues" on "assessing Debts" at EuroZone, needing clear solutions "in order to make Data .. more reliable".

More Critical, Dutch Liberal MEP Sophie in't Veld, observed that "the Real Problem is not only Greece", but the need to make an "Enquiry" to find out how many actors from inside the EU Commission, EuroStat, and/or Member States ought to know what really happened then. And, pointing to the fact that, at similar issues "in Private Business", we see Executives being persecuted and even going to Jail, she called for "an Investigation to see if Crimes were committed, in the (1999-2001) case of Greece, and if there are possibly Criminals who have knowingly committed Fraud and Destabilized the EuroZone's currency".

Veld was surprisingly supported not only by various other EU Countries' MEPs but even by Greek MEP Chountis from EuroLeft, who asked "EuroStat" and other EU Officials what they knew "about this operation of Alchemy in Greece and other Countries" with "Goldman Sachs" and others, whether "there is a procedure to punish those Former Officials" who "knew about this", and "if High Level Officials involved can be brought to Court" ?

But in such, and other, even more critical MEP's questions, (f.ex. Belgium's Conservative MEP Derk Jan Eppink, who asked "when EU Commission knew" about the inaccurate Debt data, and whether there will be any "exit" or other persuasive Sanction in EuroZone's "new Compliance mechanism", etc), surprisingly, there were not fully satisfactory answers, since several main points made by these and other MEPs were too often left open...

Such demands were also noted by mainstream German ChristianDemocrat/EPP MEP Werner Langen, who prefered to focus on the need to ensure EuroZone's "Stability", but questioned also the fact that "some (EU) Member States want to take Goldman Sachs to Court for the role it played in the case of Greece and other Countries".

However, on "Sanctions" for eventual "Crimes" committed from the crucial period of 1999-2001 (See supra), EuroStat's leadership mainly turned towards the Future by pointing at a recent "Proposal" to ask EuroZone's Member States that "Officials responsible for reporting" accounts' data to the EU become" Accountable". States' replies are "awaited until December 2011 (sic !)", Radermacher simply noted..

But, Radermacher revealed, in reply to another MEP's question, that, indeed, back in 1999-2001, it wasn't only Goldman Sachs, but "also Other Agencies, which have been active" on Swaps controversial deals, both in Greece, and in Belgium, Germany or Italy, etc.

However, all EU Member Countries were "requested" recently (in 2010) to "Investigate thoroughly" such issues as Swaps etc., and "all (concerned) Governmentrs corrected their Data" from 2001, including, f.ex. Italy, Belgium, Poland, etc. "But the Greek (PASOK) Government is the only one which has not yet corrected their (1999-2001) Deficit", EU Commissioner Rehn criticaly observed, asking the current Greek Government to "resolve Quickly" this outstanding issue, (for which, the National Statistics Agency's head was unexpectedly absent in this Hearing, as Chairwoman Bowles observed, anouncing that this "3rd Part" of EU Parliament's hearing was, therefore, "postponed".

Goldman Sachs' Chairman, Gerald Corrigan, in a much awaited testimony, admitted the fact that the U.S. Company had started Swaps' deals with the former "Socialist" Government in Greece as early as "since 1998-1999-2000", (i.e. well before the April 2000 National Election and the 2001 entry into EuroZone).

In particular, Corrigan acknowledged a 2,2 or 2,4 Billion € Swap, which should have been accounted "as a Loan" (i.e. Debt) according to what are explicitly asking the present (2010) Rules (See infra), but wasn't back in 1999-2001...

However, he curiously appeared eager to repeatedly deny that the earlier, "1998-1999-2000 swaps" might have anything to do with the EuroZone's issue, prefering to focus, instead, mainly on the subsequent, "2000-2001" Swaps.

According to the experienced Top U.S. Bank Official, "Financial Reporting", particularly "on Sovereigns (States), is much more an Art, than a Science" (sic !), as he said, because "in the Sovereign space there are Financial Obligations of Governments which are not always included in the Budgets", while experts "cannot anticipate for any eventual contingency that arrives".

However, Corrigan acknowledged that, in the Past, there were some previous" Structural Weaknesses", against which "Progress was made" later-on, "after 2005", (i.e. much later than the crucial events).

Goldman Sachs' Chairman, replied negatively to Austrian MEP Hans Peter Martin's question if he would "do again" now (in 2010), what was done back on 1999-2001 in Greece's case : - "We'd do it in a Different manner", he admitted.. Because, if the explicit, crystal clear Rules which were added from 2008 had already "applied to 2001, then, this Issue would not have arisen"...

In particular, Corrigan acknowledged that USA's Goldman Sachs had been already involved in Swaps' deals with the former Socialist Governments in Greece as early sas since .. 1998, 1999 and 2000.

>>> And he admitted that it was such kind of Swaps' deals which "resulted into a "De Facto" REDUCTION by 1,5 %, in terms of GDP ratio, of the Greek Plan of Public Debt".

- The "original, primary purpose of those early Swaps was to adapt US Dollar - denominated Debts into Euro € denominated debt", he explained. "But, as those Early Swaps went through", the "Euro € depreciated much sharply, related to the U.S. dollar $", Corrigan observed.

- Thus, "at the time of 2000 - early 2001, that led to Decisions which are partly at the origin" of the issue at stake : "Take the Original Swaps, which were at about Market Rates, and transform them to Historic Rates' Swaps". "And it was that Decision, to Restructure the Original Swaps, that created the (present) Issue" : Because it was Moving the Initial Swaps from Market Rates to Historic Rates, that produced the situation" of the above mentioned "Reduction" of Debt accounts.

However, Corrigan was unable to give any clear Reply to EuroStat's new Head's Question on a Crucial point :

- "The 2000-2001 Swap was 2,4 Billions €, but you sold these Swaps for 5,1 Billions € in 2005 to the National Bank of Greece", Radermacher observed.

- "That makes me Doubt that at the moment of 2000-2001 it was a pure "Market" Rate... Was there some kind of Hidden component" in the Goldman Sachs' Deal witth the former Socialist Governments in Greece, whereby the Debt was Reduced and "Transposed" into a Later moment of Time, in the very moment of exchanges about Greece's entry in the EuroZone ?", he critically asked.

Astonishingly, Goldman Sachs' Chairman was obliged to avoid that critical point, by simply claiming : - "I don't know anything about your references", and "I cannot comment on some other facts that you mentioned" !....

On the contrary, Corrigan again focused into practically repeating only the same point that he had already made earlier :

I.e. that "If we go back to 1998-1999-2000, my Understanding is that ...at the Beginning of 1998 or perhaps 1999 (?), Goldman Sachs and Greece entered into Serious Foreign Exchange Transactions. Most, if Not All of Greece's Credit Exposure, was sold to Other Market Participants". "These Original Swaps were all at Market Rates", he insisted.

- "But, as we got into 1999, 2000 and 2001, there was a Substantial Depreciation of the Euro € vis a vis the US Dollar $. In that Context, .Greece, initially, I think, for the 1st time about 8/2000, used "Historic" Exchange Rates. Those were (indeed) Differend from the Market Rates", and they found that "satisfactory".

- "On the basis of that experience, All the Existing Swaps (from the Past Years), which were (already) Outstanding as of Spring - early Summer 2001, were "Restructured" using Historic Rates, and it was that Restructuring, in the context of the introduction of Historic Rates, that produced the situation in which Greece, in fact, got a - 1,5% Debt Reduction in GDP ratios."

- In particular, "I think it was a 2,2 or 2,4 Billion $ Allocation", then, (given from U.S.A. Bank Goldman Sachs to the former Socialist Government in Greece shortly after December 1999 EU Summit which gave a controversial "Accession Candidate" Status).

This amount, according to today's explicit Rules, "would appear as a LOAN", admitted Corrigan. "Therefore, there would be (now) no Reduction in the Deficit of Greece", since, what happened back in 2000 had, meanwhile, been explicitly declared as illegal...

---------------------------------

Bernanke compares the 1998-2001 Goldman Sachs - former Socialist Greek Government deal with ENRON's 2001 Scandal !

-------------------------------------

As if he would be making an indirect hint to MEP's calls for Investigations about possible "Criminal" Responsibilities, earlier this same day, the Chairman of U.S. Federal Reserve, Dr. Ben Bernanke, at a subsequent Hearing by US Congress' Joint Economic Committee, only a few hours later, indirectly compared the Goldman Sachs - former Socialist Greek Government 2000 deal with the infamous ENRON Scandal, by making it clear that such moves had been even explicitly outlawed after the changes which appeared necessary in order to prevent in future so grave Accounting manipulations as at the ENRON case...

- "Many Executives at Enron were indicted for a variety of charges, and were later sentenced to Prison" over "the largest corporate Bankruptcy in U.S. history" until 2001, Wikipedia reminds in this regard. "Enron's Auditor Firm .... was accused of applying "Reckless Standards" in their Audits", while receiving "Significant consulting Fees" by Enron, which went bankrupt over several such "Accounting Issues", it notes.

---------------------

Contrary to inaccurate, too lenient initial Press Reports, Bernanke did not claim that, "Goldman Sachs didn't violate any law by helping Greece to lower its Public Deficit on... 2000", as mainstream Greek Newspaper "Kathimerini" immediately claimed, citting "Reuters" British Agency, as also did mainstream Economic Media "Le Point", adding that "Bernanke didn't evoque .. any intentional manipulation of Accounts", citting AFP Agency. Neither did he "stress.. that there wasn't any intentional violation of law", as "Naftemporiki" Economic Media also claimed, citting both Athens' Press Agency (ANA) and AFP. (Various other examples could be easily added).

In fact, Bernanke confirmed that "Goldman Sachs's currency swap with Greece a decade ago distorted the EuroZone country's public Debt level", Dow Jones newswires were obliged to rectify, publishing a Heading : "CORRECT: Bernanke: Goldman's Greek Deal Distorted Debt", ... a whole Day later !

- "The deal reduced Greece's outstanding debt by converting the debt into euros and then restructuring the debt at more favorable rates. In return for the lower rates, Greece paid Goldman back over time (i.e. after its too early and unprepared entry in EuroZone) through payments attached to another derivative product", Dow Jones added.

-"But the amount was small and the U.S. Bank has taken steps to avoid making similar deals" in the Future, Dow Jones tried to explain afterwards.

Considering that, for such blunders to be surprisingly committed by mainstream Press Agencies as Reuters, Dow Jones, AFP or ANA, etc, probably some inaccurate transmission of first hand data by any intermediary standing between the Media and U.S. Congress might be the real cause, "EuroFora", on the contrary, searched to find the exact and full Bernanke's statements at US Congress' 2,5 Hours-long exceptional Hearing, in reply to 2 questions by its Chairwoman.

Indeed, the real, full Bernanke statements seem much more interesting than the inaccurate initial Press reports claimed :

He was replying to a 1st question by U.S. Congresswoman Carolyn Maloney, Chair of the Joint Economic Committee (which brings the Senate and the House of Representatives exceptionally together), "on International Banking" : - " I'd like to ask your assesment on Greece : On February 2010 you said that Fed. is going to look into the way Credit Swaps on Sovereign (State's) Debt" were provided by Goldman Sachs back in 1999-2001. "What did you found ?", she asked.

- In fact, the experienced Chairman of U.S. Federal Reserve, professor Bernanke, made it clear that the Goldman Sachs - former Socialist Greek Government deal "had the Effect of .. Changing the Reported Debt and Deficit Rations that Greece reported to the European Statistics Agency, EuroStat", back in 2000.

- These Swaps "did have an effect in DISTORDING the Numbers, by changing the Deficit Ratio to about 1% )" (in GDP ratio)", (in fact : 1,5% : See Goldman Sachs' own statements, supra), Bernanke noted. In particular, the 2000 deal had "an Effect on the reported Deficit by changing it ... to 100%", ( i.e. giving the false impression that it wasn't over 100%, but under)...

- In particular, when "we looked at the Goldman Sachs' arrangement with Greece... we found that there was, on 2000 - 2001, a Contract between the (former "Socialist") Greek Government and Goldman Sachs, in which, by using Exchange Rates that weren't the Market Rates, these had the Effect of modestly changing" the Accounts, he noted.

- Such "arrangements which are basically intended to have Accounting Impacts,

essentialy to affect the Accounting of a Ratio", were, shortly afterwards, explicitly outlawed, after "the ENRON episode (See supra), following which, the Fed. and all Banker Supervisors strengthened Rules against" such deals, Bernanke denounced.

- Thus, the 2000 controversial deal did create a real "Issue", that US Fed's Chairman had to "discuss with Goldman Sachs", in order to make sure that "required" changes brought afterwards this troublesome "situation, .. now (i.e. on 2010), well under Control", while "Goldman Sachs sold this position on 2005 to a Greek Bank", he added, (clearly implying that this situation was not under control back in 2000)...

- In particular, Goldman Sachs was "required" to "have a much more elaborated procedure Now (in 2010), ... in order to make sure that .. such possible Deals... are not motivated by Accounting, and other kind of appearances' Issues", Bernanke concluded on this affair.

Adding to the Exceptional character of this particular Politico-Financial (See supra) case, US Fed's Chairman also revealed that, in general, it's rather Rare for U.S. Banks to sell Swaps to European Countries :

- "On the Credit Default Swaps (CDS), we haven't found large positions in US Banks vis a vis European Governments. ... Exposure of US Banks in Credit Default Swaps (CDS) of direct holdings to European Governments is relatively Limited", Bernanke observed.

- "But, we haven't addressed the Question specifically of using CDS to Manipulate Prices, which, of course, would be illegal and inappropriate. That will be more a ACC Responsibility, (and) I know that they are looking at that issue", be carefully warned.

----------------------

Questioned anew by the Chairwoman of U.S. Congress' JEC, Maloney, whether he was "satisfied with the Solution Europe has reached on Greece" or if he "see(s) the Problems seen in Greece spilling over to other adjacent Countries, or possibly having an impact to the US ?", Bernanke replied in a way which seems to partly confirm "EuroFora"'s earlier NewsReports about EuroZone's decision-making "process, stage by stage"' :

- "Well, it's a Work in Progress... I think they ( EU) made a good bit of progress, but It's Politically Difficult. Because, on the one hand, Europeans don't want to "assist" Greece, unless they are persuaded that Greeks has made a very good effort of their own to reduce their Deficit and improve their Fiscal position. At the same time, the Europeans themselves have to agree how to share burdens, and how they are going to set up the arrangements"; i.e. with which Conditions.

Therefore, " I think (that) there will still be further Discussions going forward" inside EuroZone, Bernanke concluded.

. "I think that, that there is a broad understanding that it's very important for them to come to a solution, and there is a good bit of progress there. US is not directly involved in these negotiations, but I've been informed that they (EuroZone) made Good Progres, and they are quite confident that a Solution would be forthcoming", he estimated

------------------------------------------------

Political Controversy starts over Historic Economic Facts : Key period 1981-2010

----------------------------------------------------------

EU Member Greece would certainly have entered into the EuroZone, but perhaps a little bit later, and/or it would have been clearly warned beforehand about the main necessary Reforms, that it might have accomplished sooner or later.

On the contrary, by entering earlier than normaly and/or unprepared, Greek Economy was inevitably exposed (without the usual Monetary/Fiscal arms that any Country disposes before its entry to EuroZone) to harder than others obstacles to catch up with a Productivity Gap, which, afterwards, widened considerably, f.ex. vis a vis Germany and other Countries, making it more difficult to re-fund the debt of the past.

Thus, the main immediat profit from a so early and/or unprepared entry was Political, and only for a former "Socialist" Government which notoriously used the perspective for Greece to enter immediately to an EuroZone dominated then by similar "Socialist" or coalition Governments (f.ex. in France, Germany, Italy, Luxembourg, etc) in order to snatsch the April 2000 Greek Election with a small margin of less than 1%..

Main Opposition Party, "New Democracy" (ChristianDemocrats/EPP) recognizes only some 13 Billions € of Debt left by its former Governments since 1981, on 1992 and for 2004-2009, out of the total Debt which is more than ... 300 Billions €, accusing the various "Socialist" (PASOK) Governments, "particularly from the Decade of the 1980ies", as well as during 1994-2004 until now 2009-2010, to be the main responsible for the bulk of more than 287 billions €...

The main thrust of this fact results clearly from OECD's recent Graphics on the evolution of many Countries' Debt during the last 30 Years, which reveal that Greece's Debt grew at the Decade of the 1980ies, and became higher and higher during all this period of former PASOK governments. (While a short ChristianDemocrat interval with Costas Karamanlis, in mid 2004 - mid 2009, despite a real amelioration, didn't, however, adopt radical enough measures to really change the situation it inherited from a long "Socialist" Past)..

Moreover, the new ND (ChristianDemocrat) Leader, former MEP and Foreign Minister, Antonis Samaras, has just denounced the current "Socialist" (PASOK) Government to have provoked, in addition to the problem of the old Debt, also "a new problem of Borrowing" money, after a controversial worsening of the publicly anounced accounts, pointing at the fact that the Interest Rates asked by the Market for Loans to Greece suddenly grew, from only ..1% to more than ... 7% in just a few months !

The next EU Parliament's Economic Committee's meeting is scheduled for next Monday, April 19, during the Weekly Full Plenary Session in Strasbourg.

Main Menu

Home Press Deontology/Ethics 2009 Innovation Year EU endorses EuroFora's idea Multi-Lingual FORUM Subscribers/Donors FAQs Advanced search EuroFora supports Seabird newsitems In Brief European Headquarters' MAPs CoE Journalists Protection PlatformBRIEF NEWS

- 00:00 - 02.06.2021

- 00:00 - 18.10.2020

- 00:00 - 19.06.2020

- 00:00 - 18.05.2020

- 00:00 - 20.04.2020

- 00:00 - 02.02.2020

- 00:00 - 09.12.2019

- 00:00 - 27.11.2019

- 00:00 - 16.11.2019

Popular

- Yes, we could have prevented Ferguson riots says World Democracy Forum's Young American NGO to ERFRA

- Spanish People Elect CenterRIGHT Majority with 1st Party and Total of 178 MPs (6 More than the Left)

- Pflimlin's vision

- The European Athletic "Dream Team", after Barcelona 2010 Sport Championship Results

- Source Conseil d'Europe à ERFRA: Debatre Liberté d'Opposants à Loi livrant Mariage+Enfants à Homos ?

- Head of BioEthics InterGroup, MEP Peter Liese : "Embryonic stem cell research reaching its END" !?

- Spain: Jailed Turkish Terror suspect with Explosive,Drones,Chechen accomplices stirs Merah+ Burgas ?

- UN Head Ban Ki Moon at CoE World Democracy Forum : - "Listen to the People !"

Latest News

- EUOmbudsmen Conference 2022: Digital Gaps affect People's Trust threaten EF Project on EU Future ?

- French Election : Black Out on Virus, but Obligation for Fake 'Vaccines" Challenged

- Both French Presidential Candidates point at "Humanism" in crucial times...

- France : Zemmour = Outsider may become Game Changer in Presidential + Parliamentary Elections 2022

- PACE President Cox skips Turkey Worst (Occupation) case compared to Russia (DeMilitarisation) query

Statistics

Посетителей: 56766642Archive

Login Form

Other Menu

Facing a 70% Abstention threat in 2009 Election, EU endorses EuroFora's idea for Citizens' debates on crucial EU decisions !

- Different views on "Europe's Future", should be debated among Citizens at June 2009 EU Elections, thanks to political Parties' "Manifestos", says EU Parliament's Report

A main idea, initiated and promoted by EuroFora's founders since 1997: the vital need to develop European Citizens' democratic right to actively participate in multilingual debates on EU decisions, is formally endorsed by the EU from 2009 !

The move is a key attempt to overcome "catastrophic" Polls which warn that only ...30% of Citizens are ready to vote in the forthcoming June 2009 EU Election ! This was revealed by EU Commission's vice-president, in charge of Communication policy, Margot Wallstrom, during a "hot" meeting of EU Parliament's Committee on Culture and Education, during the December 2008 Strasbourg session.

Wallstrom faced criticism, but also suggestions from various MEPs, naturally worried by Abstention threats which herself found even "worse" than in 1999 or 2004...

A Report on "Active Dialogue with Citizens",examined at the same time, presented some useful practical tips, on "facilitating Interviews"; etc., but also a potentialy important call to "incorporate the conclusions of ...debates...into (EU) policies, and take into consideration the expectations that Citizens have of the EU when deciding". An amendment even implies that Citizens' participation in debates on EU decisions is a democratic "Right".

More importantly, it finds that a Debate "on the Future of Europe", (as French President Nicolas Sarkozy has asked since 2007), would be a good idea " for the 2009 European parliamentary Elections", because "clarifying the political differences between the EU political parties would help citizens to identify themselves with, and choose between various concepts", for which "all parties (should) present their Manifesto".

A "Joint political declaration on Communicating Europe in Partnership", co-signed by "the European Parliament, Council and ... Commission", confirms that they "attach the utmost importance to improving communication on EU issues", by "enabling European citizens to exercise their right to participate in the democratic life of the Union, in which decisions are taken as openly as possible and as closely as possible to the citizens, observing the principles of pluralism, participation, openness and transparency".

This should "enable Citizens to exercise their right to express their views and to participate actively in the public Debate on European Union issues", while also "promoting the respect of multilingualism". In this regard, EU confirms its "wish to develop synergies with national, regional and local authorities as well as with representatives of Civil Society".

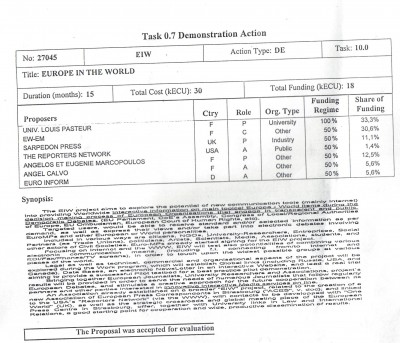

It's since 1997 that a group of EuroFora's founders have officially presented a pioneer Project (then called "EIW", for "Europe in the World"), which aimed to develop Strasbourg's "Polyphonic music", by providing "Interactive information", on "main issues ... during the Decision-making process of European Organizations which engage in Transparent and Public Democratic Debates"

This should be done, inter alia, by "exploring the potential of New Communication Tools (mainly Internet)", as well as classic-form debates, the 1997 EIW pioneer project's anounced in its "Synopsis". It was formally "accepted for evaluation" by EU Commission in Brussels in order to be examined for a grant in the framework of the "Research/Technology/Development (RTD) Programme in the field of Information Technologies", then called "ESPRIT", as a "Best Practice Pilot Project".

But the vital, urgent Political need for EU to search new, efficient ways to reach the People and interact with European Citizens, was really felt in Brussels and elsewhere only after the unprecedented in History 1999 and 2004 Majority Abstention in EU Elections, followed by 3 "NO" in Referenda in France, the Netherlands and Ireland, on 2005 and 2008...

In this New Political Landscape, we prepared a new, actualised and more developed version of our initial idea, in a simplified and more efficient form, thanks also to a large Experience accumulated during many years of EU/CoE/UNO Press work and Multi-lingual debates, with the New project "EuroFora" :

On 2006 we presented in Public its main lines during Questions/Replies that we raised at two Press Conferences by EU Commission President, Jose Baroso, and mainly EU Commission's vice-President, in charge of Communication policy, Margot Wallstrom, together with EU Parliament's vice-president, Alejo Vidal-Quadras, in Strasbourg, (Videos available), and we reminded it at various brief contacts with Commissioner Wallstrom in 2007 and 2008.

Meanwhile, a new Text was also presented for "EuroFora" Project mainly to certain Political and other personalities, at European, National or Regional/Local level, mainly in 2007, but also in 2008..

Now, after the unexpected 2008 Irish "NO", and before the 2009 EU Elections, which are due to be of exceptionally crucial importance for Europe's Future, the moment has obviously come to launch that project, progressively, but in real practice.

Whoever really cares for Europe and its Citizens is welcome to join, in one way or another. Only anti-European, anti-democratic, obscure or ignorant groups might oppose or attempt to "steal" and deviate the main idea.

But European Citizens, incited by enlightened political leaders, are those who will finally write the real History.

Polls

SMF Recent Topics SA

- Record Hospitalisati... (0) by Breadman

- How Many Infected by... (1) by Thunderbird

- Real Cause for Europ... (0) by Breadman

- Interesting Australi... (0) by Aurora

- Plus de mRNA Faux-&q... (0) by Aurora

- EU: Lukashenko as E... (0) by WKalina

- Why NATO in Ukraine,... (0) by Geopol

- Afghanistan's key : ... (0) by Thunderbird

- Anti-Pass Demonstrat... (0) by Aurora

- Veran - Fioraso : Mê... (1) by JohnsonE